Table of contents

What is a non-recoverable draw?

A non-recoverable draw is a guaranteed advance payment given to a sales rep during a pay period that does not need to be paid back—regardless of whether the rep earns enough commission to cover the draw.

It’s essentially a financial cushion. You guarantee a minimum level of income (called the draw amount), which the rep keeps, even if their commission earnings fall short.

This model is common when onboarding new reps, launching into new markets, or operating in industries with long sales cycles where commission-based income can fluctuate.

How a non-recoverable draw works

Let’s say a rep is offered a non-recoverable draw of $2,000 per month. This draw acts as a baseline during the ramp-up period.

If in one month, the rep earns $1,500 in commission:

- They still receive $2,000

- The shortfall of $500 is not clawed back in future months

In another month, if they earn $3,000 in commission:

- They receive $3,000 (not $3,000 + $2,000)

- The draw only applies when earnings fall below it

Unlike recoverable draws against commissions, the rep doesn’t have to “pay back” any difference. It’s a true guarantee, not a loan or advance.

Most traditional compensation structures still rely on outdated models that don’t reflect today’s dynamic sales environments. As Harvard Business Review puts it, “Although the business environment is completely different than it was 20 years ago, the way most companies structure sales quotas and compensation has not evolved to keep up.” This is exactly why many high-growth teams are turning to tools like non-recoverable draws to stay competitive and motivate reps with more precision.

Use case example: Ramp-up periods

A fast-growing SaaS company hiring new business development reps offers a non-recoverable draw of $2,500/month for the first 3 months.

The rationale:

- Sales cycles average 90 days, so commission earnings lag

- The draw ensures financial stability during onboarding

- It helps the company attract and retain top talent in a competitive hiring environment

Non-recoverable vs recoverable draws

Both types of draws are advances on commission earnings, but their financial implications differ:

| Feature | Non-recoverable draw | Recoverable draw |

|---|---|---|

| Payback required? | ❌ No | ✅ Yes |

| Works like a loan? | ❌ No | ✅ Yes |

| Risk to rep | Low | Moderate |

| Common usage | New hires, long sales cycles | Experienced reps, short cycles |

| Employer cost | Higher (guaranteed) | Lower (recoupable) |

Non-recoverable draws offer more protection to the rep, while recoverable draws shift more risk to the employee.

Pros and cons of a non-recoverable draw

✅ Advantages

- Improves financial stability for reps, especially in ramp-up phases

- Helps attract top sales talent in competitive markets

- Reduces early turnover due to inconsistent pay

- Encourages long-term focus over short-term pressure

- Easier to budget from a finance perspective (fixed draw amount)

❌ Disadvantages

- Higher cost to the company if reps underperform

- Can disincentivize hustle if not tied to performance metrics

- May create confusion without proper tracking and transparency

How Remuner helps:

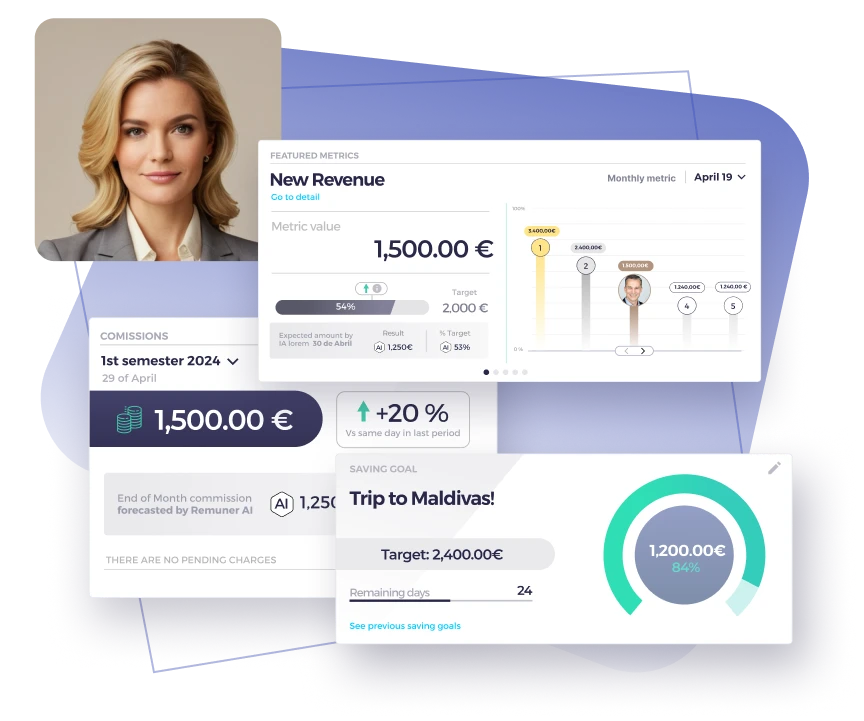

Remuner allows you to build and manage compensation structures with non-recoverable draws, recoverable draws, accelerators, and more. You can:

- Set up draw policies by role or tenure

- Track draw balances, commissions, and OTE in real time

- Simulate plan changes without complex spreadsheets

👉 Design your sales compensation plan with Remuner

When to offer a non-recoverable draw

Here are common situations where a non-recoverable draw makes sense:

1. New hire ramp-up

Give new reps income security while they learn the product, CRM, and process.

2. Long or seasonal sales cycles

In industries where deals take months to close (e.g. enterprise SaaS), a draw smooths out income fluctuations.

3. Expanding to new markets

If a territory has no pipeline yet, reps will need time to generate opportunities.

4. Competitive hiring conditions

Offering a draw helps attract high-performing candidates looking for income predictability.

How to structure a non-recoverable draw

To get the most from this model, treat it like a tool—not a permanent fix. Structure it thoughtfully:

- Set clear time limits (e.g. 3–6 months)

- Tie performance reviews to draw expiration

- Combine with quota ramping to set achievable expectations

- Use commission tracking software to maintain clarity

Example: Quota ramp + non-recoverable draw

- Month 1–3: Draw = $2,500 / Quota = 50%

- Month 4–6: Draw = $1,500 / Quota = 75%

- Month 7+: No draw / Full quota + accelerators

This structure gives reps time to build pipeline and prove themselves—while keeping incentives aligned.

Common mistakes to avoid

If you’re implementing a non-recoverable draw, steer clear of these traps:

- Offering it indefinitely with no performance check-ins

- Not communicating how the draw works in simple terms

- Failing to align draw periods with realistic sales performance expectations

- Using spreadsheets instead of a dedicated commission tracking tool

Why clarity matters: The psychology of compensation

Sales reps care deeply about how they’re paid. If your compensation structure isn’t transparent, you risk:

- Distrust in leadership

- Misaligned performance incentives

- Unnecessary attrition

Remuner solves this by providing real-time dashboards that show:

- Commission earnings per deal

- OTE progress

- Draw amounts and payout timing

Example: How a sales team used a non-recoverable draw

Company: Mid-market HR tech firm

Challenge: New reps were churning after 60 days due to unpredictable commission checks

Solution: Introduced a 3-month non-recoverable draw of $3,000 with a ramped quota

Result:

- Rep retention improved by 40%

- Average sales performance stabilized after month 4

- The company was able to attract experienced talent without overhauling base salaries

Discover how Remuner helped Orbidi: “We have seen a consistent 8% increase in revenue since using Remuner. With these results, we have paid the cost of Remuner more than 25 times!”

Improve your sales compensation plan

The non-recoverable draw isn’t a cure-all. It’s one element in a broader sales compensation plan that must balance motivation, retention, and financial risk.

Use it with intention—whether to reduce ramp-up anxiety, compete for top talent, or protect reps from long sales cycles.

And most importantly, manage it with transparency and accuracy. With Remuner, you can design, test, and scale compensation structures that support sales performance while maintaining control.

FAQs about Non-recoverable draw

What is a non-recoverable draw in sales compensation?

It’s a guaranteed advance that a rep doesn’t have to repay, even if they don’t earn enough commission in a given period.

How is a non-recoverable draw different from a recoverable draw?

Recoverable draws are repaid through future commissions. Non-recoverable draws are not. They offer more stability to the rep but cost more to the employer.

When should I offer a non-recoverable draw?

During ramp-up periods, when expanding into new territories, or when hiring in competitive markets where consistent income matters.

Can I track non-recoverable draws automatically?

Yes. Use commission tracking software like Remuner to manage draws, commissions, and OTE all in one place—no manual work needed.